LINK Token Price Outlook: Ecosystem Expansion & Mid-to-Long-Term Positioning

Latest Developments in the Chainlink Ecosystem

Chainlink recently introduced the Automated Compliance Engine (ACE), a tool designed to align blockchain operations with traditional financial regulations, delivering robust compliance solutions for real-world assets (RWA) and institutional capital.

Furthermore, Chainlink is collaborating with leading global financial infrastructure providers—including SWIFT, DTCC, and Clearstream—to drive the migration of traditional finance onto the blockchain. As the network’s economic cornerstone, LINK is expected to benefit significantly from these strategic alliances.

Live LINK Token Price

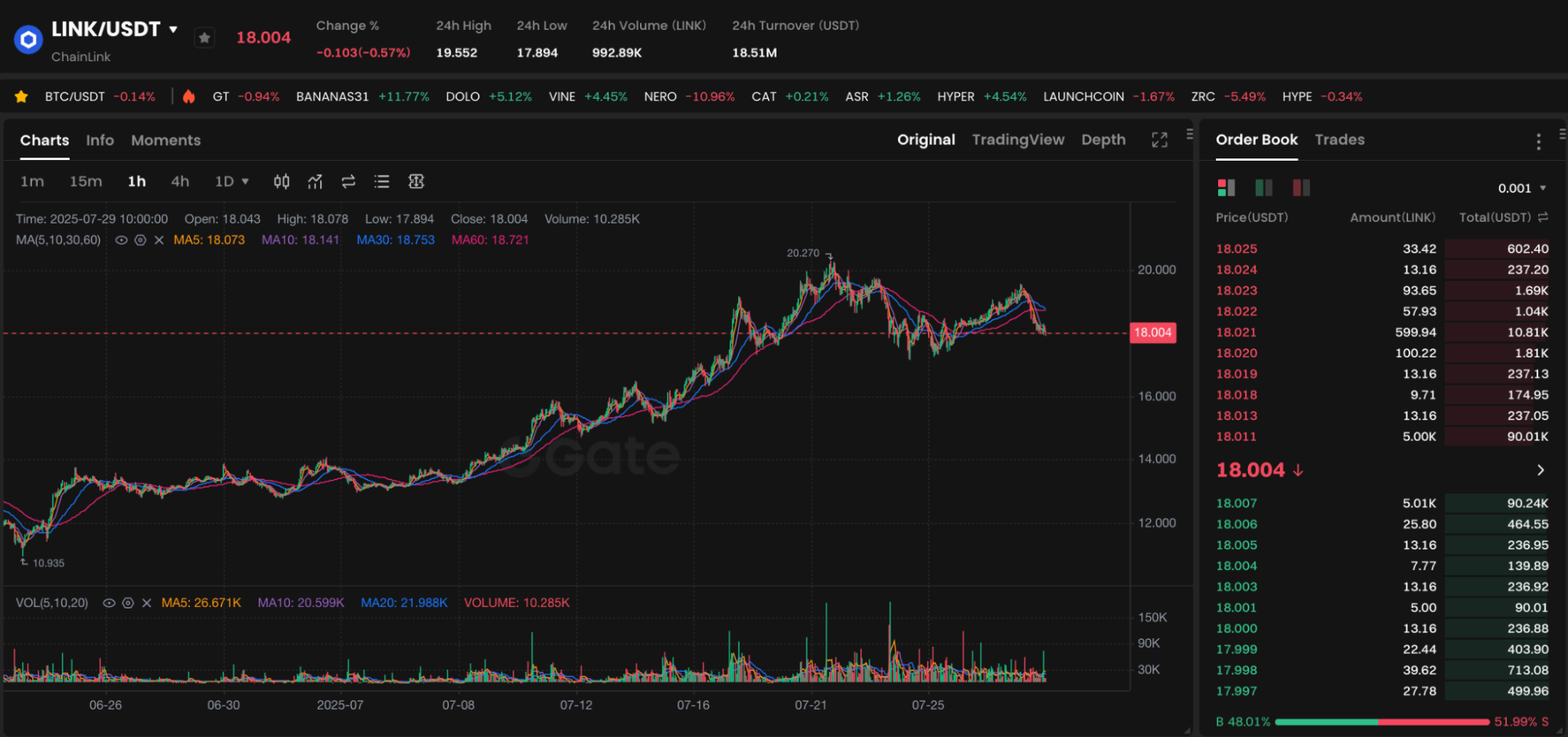

Chart: https://www.gate.com/trade/LINK_USDT

Currently, LINK/USDT is trading at 18.13 USDT on Gate, having fluctuated within the 17.80–18.70 USDT range over the past 7 days, demonstrating a generally strong performance. LINK consistently ranks among the top 15 global crypto assets by market capitalization. Its total market cap exceeds $10 billion, signifying broad acceptance and recognition in the industry.

Key Mid- and Long-Term Value Drivers

1. Multi-Chain Expansion Broadens Use Cases

LINK now operates on major blockchains such as Ethereum, BSC, Arbitrum, Solana, and Polygon. Its oracle solutions are widely adopted for applications such as lending, insurance, and stablecoin minting.

2. Staking Model Ensures Ecosystem Stability

The LINK staking mechanism incentivizes node operators through robust rewards to maintain data accuracy and network stability. The forthcoming 2.0 upgrade aims to introduce more granular staking pools and optimized yield models, which is expected to enhance long-term token lock-up rates.

3. Cross-Chain Interoperability Protocol (CCIP) Emerging as Primary Catalyst

Industry participants hail CCIP as the “SWIFT for blockchains,” and Synthetix, Aave, and JPMorgan have already integrated and tested it. CCIP will play a vital role in cross-chain asset transfers and data synchronization, and it will continuously drive demand for LINK.

Price Trends and Technical Analysis

Technical analysis reveals LINK has established a robust interim bottom, with the MACD showing positive momentum and the EMA indicators signaling a bullish crossover.

The mid-term price target is 22–25 USDT, while, for the long term, a sustained breakout above the 30 USDT resistance zone will be key. Should BTC begin a fresh mid-term rally, LINK could similarly retest its previous highs.

Investment Strategy and Risk Management

- Gradual accumulation: Accumulate within the 17.00–18.00 USDT range

- Stop-loss level: Set below 16.50 USDT to limit downside risk

- Take-profit target: 22.00–25.00 USDT, implement phased profit-taking

Investors should also monitor LINK’s financial reports, development milestones, and staking updates on a regular basis to inform ongoing portfolio decisions.

Future Outlook

As Web3 technology and real-world assets (RWA) become increasingly integrated, Chainlink is positioned as a crucial compliance enabler in the evolving digital asset landscape. As the exclusive token of the project, LINK supports payments, collateralization, and governance, providing durable value. For newcomers, gaining a sound understanding of Chainlink’s technical framework and ecosystem potential will be instrumental in capitalizing on the foundational opportunities emerging in on-chain data infrastructure.