BTC Price Prediction: Bitcoin Drops 8.3% From Peak, Can $113,800 Hold Key Cycle Threshold?

Preface

Recent movements in Bitcoin (BTC) prices have once again fueled debates about the four-year halving cycle. According to on-chain analytics firm Glassnode, while institutional investments and ETF flows are reshaping the market structure, Bitcoin’s current performance closely mirrors historical cycles.

Is the Bitcoin Price Cycle Entering Its Later Stages?

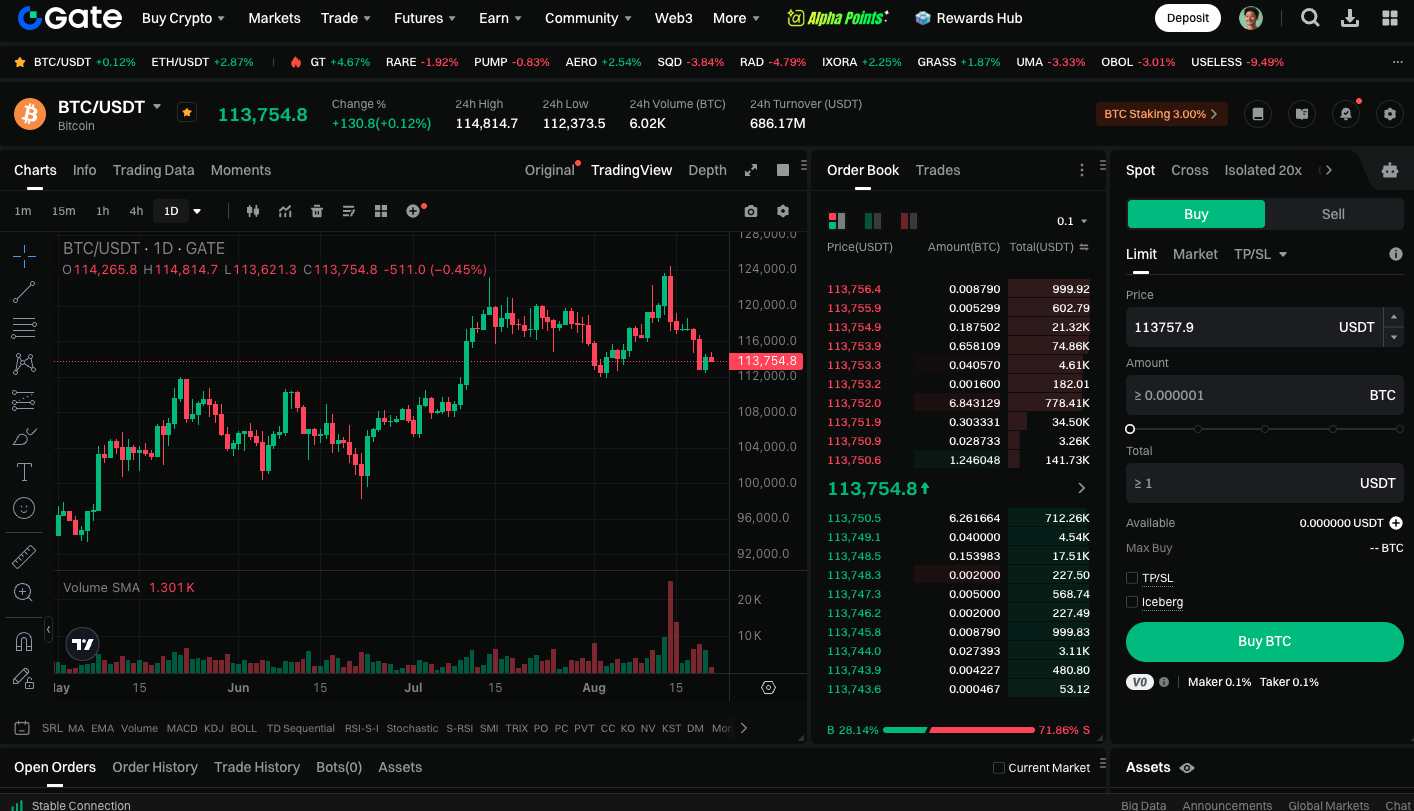

On August 14, 2025, Bitcoin hit an all-time high of around $124,128, followed by profit-taking that led to a price decline to $113,800—a drop of about 8.3%. Glassnode observes that the profit-taking activity among long-term holders (those holding for over 155 days) now matches the scale seen during previous peak periods, which could signal that the market is moving into the latter part of the cycle. Meanwhile, the intensity of capital inflows has started to cool. Data from Farside Investors shows that over the past four trading days, spot Bitcoin ETFs saw a net outflow of about $975 million, indicating that some investors are scaling back positions near recent highs.

Investor Appetite Shifts Toward High-Volatility Assets

With demand slowing, the market has increasingly turned toward volatility-based trading strategies. Glassnode notes that open interest in major altcoin derivatives markets once surpassed $60 billion. Although it later declined by about $2.5 billion, this demonstrates ongoing speculative interest. If Bitcoin follows its historical halving pattern, a new peak may occur around October. In both the 2018 and 2022 cycles, highs occurred roughly 550 days after halving, which is closely aligned with the current stage of the cycle.

Has the Four-Year Cycle Broken Down?

Not all analysts agree that the halving cycle still holds. Some institutions argue that with more corporate treasuries and pension funds allocating to Bitcoin, this market cycle may diverge from prior patterns.

Investor Jason Williams points out that the top 100 corporate holders collectively own nearly 1 million BTC, signaling a fundamental shift in market structure. Bitwise CIO Matt Hougan goes further: “The four-year Bitcoin cycle is dead,” he asserts, predicting that 2026 will still be “a year of growth for Bitcoin.”

Potential Impact of 401(k) Retirement Plans

Another often-overlooked catalyst is the inclusion of Bitcoin within 401(k) retirement plans—a market with trillions of dollars under management. Even a small allocation to Bitcoin could bring sustained liquidity and long-term buy-side demand. Key features of including Bitcoin in 401(k) plans are:

- Long-term horizon: Retirement funds tend to hold assets for decades, which may reduce short-term market volatility.

- Systematic contributions: Fixed monthly payroll deductions create persistent buying pressure.

- Institutional management: Major asset managers must make direct allocations, further expanding the scope of regulated demand.

To trade BTC spot, visit: https://www.gate.com/trade/BTC_USDT

Conclusion

With Bitcoin trading at roughly $113,800 at the time of writing, the asset sits at a pivotal juncture in its cycle. Another record high may be reached by October if support holds and the uptrend resumes. If demand continues to lag, a retest of the key psychological $110,000 level may occur.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025