Stablecoins, Global Velocity, and the Internet of Capital

Stablecoins have emerged as a powerful layer of global finance: programmable, borderless, and fast. From facilitating remittances to enabling real-time settlement in decentralized applications, their utility is expanding rapidly.

But beyond payments, stablecoins are quietly increasing the velocity of money: changing how often each dollar is used, where it moves, and how quickly it stimulates economic activity.

This phenomenon mirrors a shift we saw two decades ago: when the early internet transformed how money and value circulated. To understand what stablecoins are doing today, we need to go back to basics.

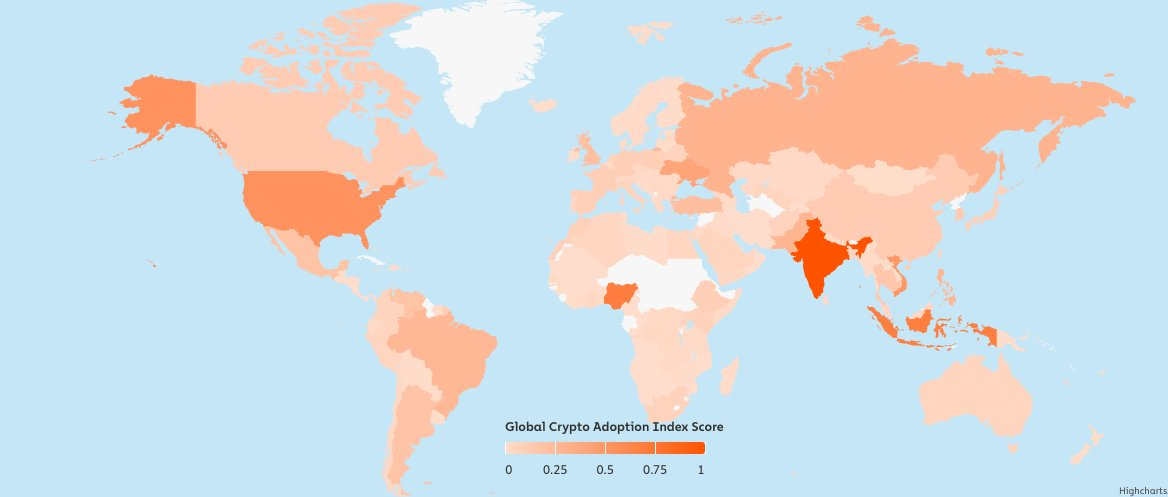

The 2024 @chainalysisGlobal Crypto Adoption Index ranks 151 countries using four sub-indexes that measure usage of different crypto services. Rankings are adjusted for population and purchasing power, averaged, and normalized from 0–1. Data is based on estimated transaction volumes from web traffic to crypto services, cross‑checked with local experts.

What Is the Velocity of Money?

The velocity of money is the rate at which money is exchanged in an economy, typically calculated as:

Velocity = GDP / Money Supply

It tells us how productive each dollar is. A high velocity means each unit of currency is used frequently to buy goods and services. A low velocity suggests that money is being saved or idle.

But “money” here isn’t a one-size-fits-all term. Economists measure it in tiers:

- M1: Physical cash + checking accounts, the most liquid form of money

- M2: M1 + savings accounts, time deposits under $100k, money market funds

- M3 (now discontinued in the US): M2 + large time deposits, institutional money market funds, and other large-scale instruments

Stablecoins, when fully fiat-backed and easily redeemable, behave similarly to M1: highly liquid and immediately spendable.

The Internet Era and the Rise & Fall of Velocity

In the late 1990s and early 2000s, the rise of the internet significantly increased the velocity of money:

- E-commerce enabled 24/7 spending

- Email sped up deal-making and contracts

- Market access broadened globally

- Digital banking made money more mobile.

This early-stage efficiency boom led to a rise in M1 velocity.

But as the internet matured, a different trend took over:

- Capital gains created vast wealth

- This wealth was saved and invested in stocks, bonds, and real estate

- More money was invested, not spent.

Velocity slowed, but GDP continued to grow, as capital formation replaced pure transactional activity.

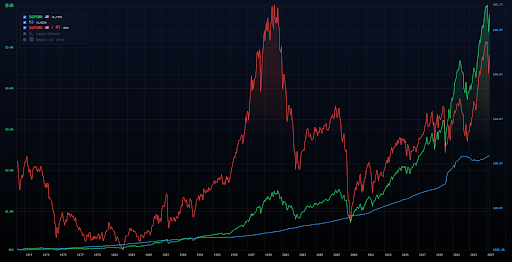

M3 and S&P500’s growth over the years

How Stablecoins Increase Global Money Velocity

Stablecoins are introducing a similar dynamic today: they dramatically increase the speed, accessibility, and usability of money. But unlike the early internet, this transformation is global from day one. Here’s how:

a) 24/7, Borderless Transfers

With stablecoins, payments are instant and continuous, even across jurisdictions. Issuers like @Circle"">@Circle, @Tether_to"">@Tether_to, and @LevelUSD"">@LevelUSD enable real-time settlement across a growing number of apps and networks.

b) Onchain Finance & DeFi

Platforms like @MorphoLabs, @aave, and @pendle_fi allow users to deploy stablecoins into lending, yield products, or liquidity provision which turns idle savings into active capital.

c) Remittances & Payments

Startups like @Stablecoin are building APIs that let businesses integrate stablecoin payments into existing flow of funds, as well as sending and receiving payments 24/7 with instant settlement globally while reducing FX costs and connect with hard-to-reach markets for last mile payouts.

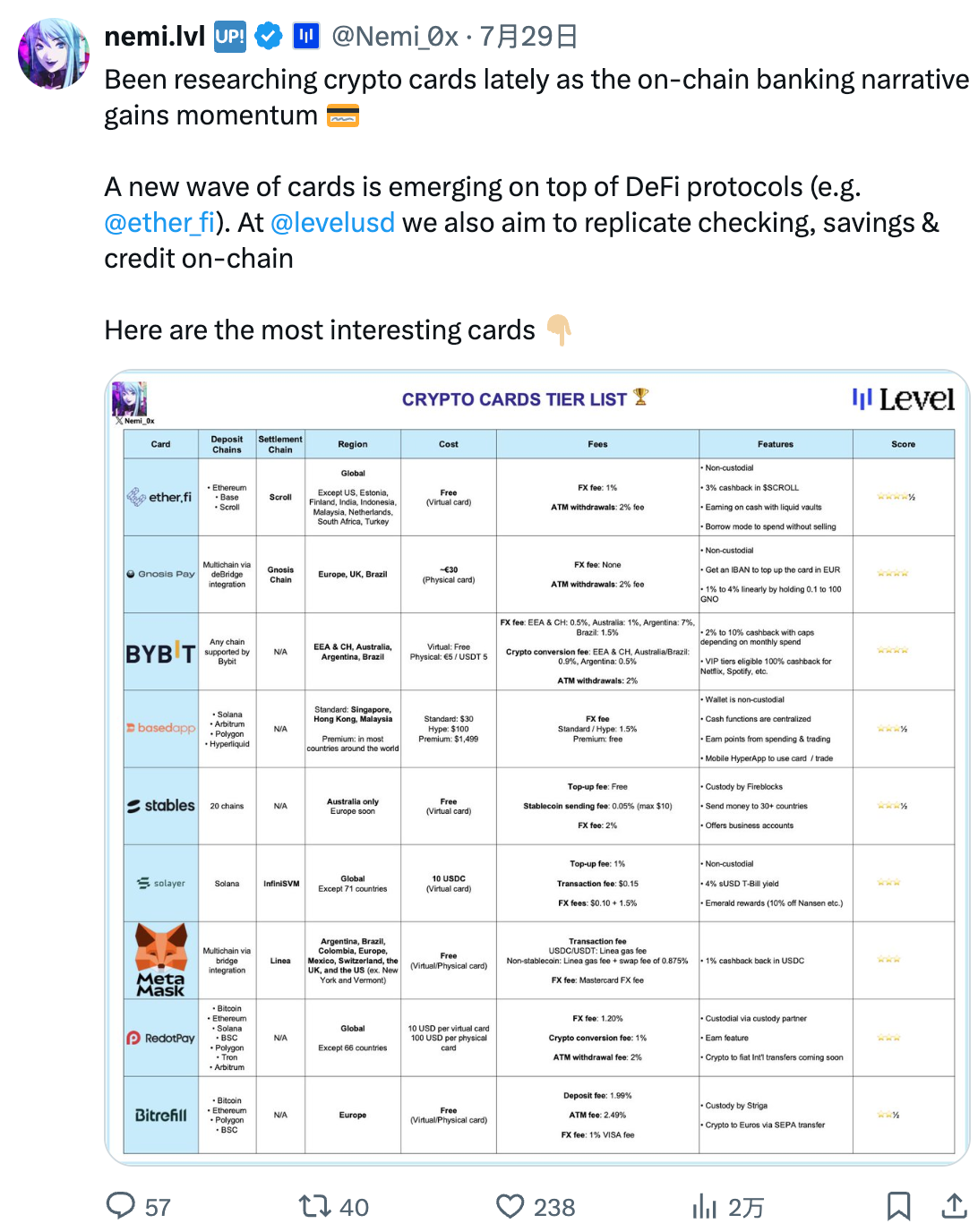

Other examples include crypto cards, which let users spend their onchain stablecoin balances directly on everyday expenses. Connected to major payment networks like Visa and Mastercard, they instantly convert stablecoins into local currency at the moment of purchase, removing the need for off‑ramping. By bridging onchain funds with real‑world commerce, crypto cards turn stablecoins into an active medium of exchange for groceries, travel, and daily needs, helping to increase global money velocity.

d) Permissionless Access to USD

In countries like Turkey, Argentina, and Nigeria, stablecoins serve as a vital financial tool, allowing users to store value in dollars and transact freely with just a phone and internet connection. By reducing reliance on intermediaries and enabling instant, borderless payments, stablecoins activate each unit of capital more efficiently and bring more participants into the economy. The result is a meaningful rise in money velocity, particularly in underbanked and high‑inflation environments.

For small and medium‑sized businesses, whether in manufacturing, agriculture, digital services, or local retail, stablecoins offer a direct link to international buyers and suppliers. They reduce the friction of cross‑border trade, eliminate settlement delays, and protect against sudden local currency depreciation. By making reliable USD access universal, stablecoins empower individuals and businesses to operate more confidently, grow faster, and keep capital circulating within the local economy. This accelerates money velocity while also strengthening economic resilience in volatile‑currency environments.

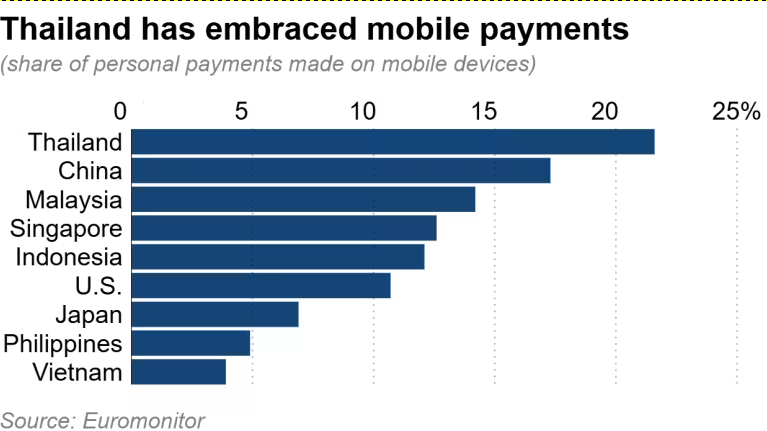

In fast-evolving markets like Thailand, Vietnam, and the Philippines, stablecoin adoption is gaining traction, particularly through P2P and OTC channels, while traditional financial institutions are working to integrate stablecoin-based transactional capabilities. In Thailand, Siam Commercial Bank (SCB), through its innovation arm SCB 10X, has partnered with Lightnet to enable cross-border payments and remittances using stablecoins on a public blockchain. This initiative marks the first instance of stablecoin-based settlement for such use cases in Thailand, setting a precedent for the regional financial industry. The integration of Fireblocks’ custody infrastructure ensures institutional-grade asset security, fostering trust between parties. Building on this foundation, SCB and Lightnet plan to expand the service to corporate clients, enabling both inbound and outbound remittances and bringing the same efficiency and cost benefits already available to retail users.

Mobile Payments Data by Euromonitor

Short-Term Impact of Increased Velocity

In the short term, increased money velocity driven by stablecoin adoption leads to tangible economic gains: GDP rises as the same pool of capital circulates more rapidly, productivity improves thanks to instant, low-friction payments and faster working capital cycles, and financial inclusion expands as gig workers, creators, and merchants transact in stable, dollar-denominated assets without needing a traditional bank.

This unlocks dormant economic potential, particularly in emerging markets where access to reliable banking is limited. Just as the early internet accelerated commerce by removing friction from communication and distribution, stablecoins are doing the same for value transfer, enabling money to move freely, 24/7, and at near-zero cost.

Long-Term Impact: From Speed to Scale

But the long-term effects are more nuanced.

As users in emerging markets gain access to dollars and stablecoins, a portion of that capital is not spent, it is saved or invested:

- Staked in DeFi for passive yield

- Used to buy assets (real estate, tokens, equities)

- Reserved for business expansion.

These actions remove money from the short-term transaction cycle, lowering local velocity.

However, this is not a negative outcome. Like in the early 2000s, it reflects the shift from velocity-driven consumption to wealth accumulation and capital formation, a sign of maturing economies.

Even if money turns over less often, it is used more productively.

In early-stage growth phases, emerging economies tend to spend more, focused on consumption, infrastructure, and catching up.

As incomes rise and financial tools become available, savings rates increase. Households start preserving wealth and investing in long-term assets.

Stablecoins can accelerate this transition.

Conclusion

Stablecoins are transforming the global flow of money, increasing both the speed of transactions and the depth of financial access. They act as velocity boosters in the short terrn and capital builders in the long run. As a side note velocity doesn’t operate in isolation and its economic impact depends on:

- Interest rates: Higher rates encourage saving, lowering velocity

- Inflation expectations: If people expect prices to rise, they spend faster

- Tariffs and capital controls: These can limit stablecoin usage in specific regions

- Fiscal policy: Government transfers, taxes, and subsidies all influence monetary circulation

Despite that, the outcome is a new type of global economy, one where stablecoins can flow instantly, settle automatically, and grow thoughtfully.

Just as the early internet reshaped communication and commerce, stablecoins are doing the same for money itself.

This shift is not about printing more, it’s about using what we already have more effectively.

Disclaimer:

- This article is reprinted from [levelusd]. All copyrights belong to the original author [levelusd]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0