Trump’s Big Move: $9 Trillion in Retirement Funds Poised to Enter the Crypto Market

Late last night, the Financial Times broke major news: President Trump is preparing to sign an executive order that would allow 401(k) and other retirement plans to invest in cryptocurrencies, gold, private equity, and other “alternative assets.”

According to three people familiar with the matter, the order will instruct federal regulators to review and potentially ease current restrictions on retirement plan investments. This would clear the way for digital assets to enter the $8.7 trillion U.S. retirement market.

This development was preceded by earlier policy signals. On May 28, the U.S. Department of Labor rescinded Biden-era guidance urging “extreme caution” toward crypto assets, calling it “regulatory overreach.” Back in 2022, Republican Congressman Peter Meijer introduced the Retirement Savings Modernization Act, which sought to bring digital assets within the framework of the 1974 Employee Retirement Income Security Act (ERISA). Although the bill didn’t pass, it set the stage for today’s policy shift.

Trump’s Digital Asset Ambitions

The core goal of this executive order is to break the long-standing focus on traditional stocks and bonds in 401(k) plans and provide greater flexibility in asset allocation.

The order will direct federal regulators in Washington to thoroughly review and work to remove existing obstacles preventing alternative assets—particularly digital assets, precious metals, and funds specializing in private equity buyouts, private credit, and infrastructure investment—from being included in professionally managed 401(k) plans.

The White House told the Financial Times, “President Trump is committed to restoring prosperity for everyday Americans and securing their economic future. However, no decision should be regarded as official policy until it is formally announced by the President himself.” Nevertheless, the Trump administration clearly signals its intent to drive crypto into the mainstream.

This move is part of Trump’s broader pro-crypto policies. From his campaign pledges to roll back what he called “overly strict regulation” of digital currencies, to his family business—Trump Media & Technology Group—investing over $2 billion in Bitcoin and other digital assets, and even launching its own stablecoin and tokens, Trump has become a major player in the digital asset world. According to disclosure, his personal crypto holdings have surpassed $51 million.

His administration has already made moves: the Department of Labor in May rescinded the Biden-era policy that discouraged 401(k) plan managers from offering crypto investment options, establishing the foundation for this executive order.

Unlocking the U.S. Pension Market: Deeper Implications

To grasp the potential impact of this policy, it’s important to understand the scale and structure of the U.S. retirement market. As one of the world’s largest pension systems, U.S. retirement assets total around $9 trillion.

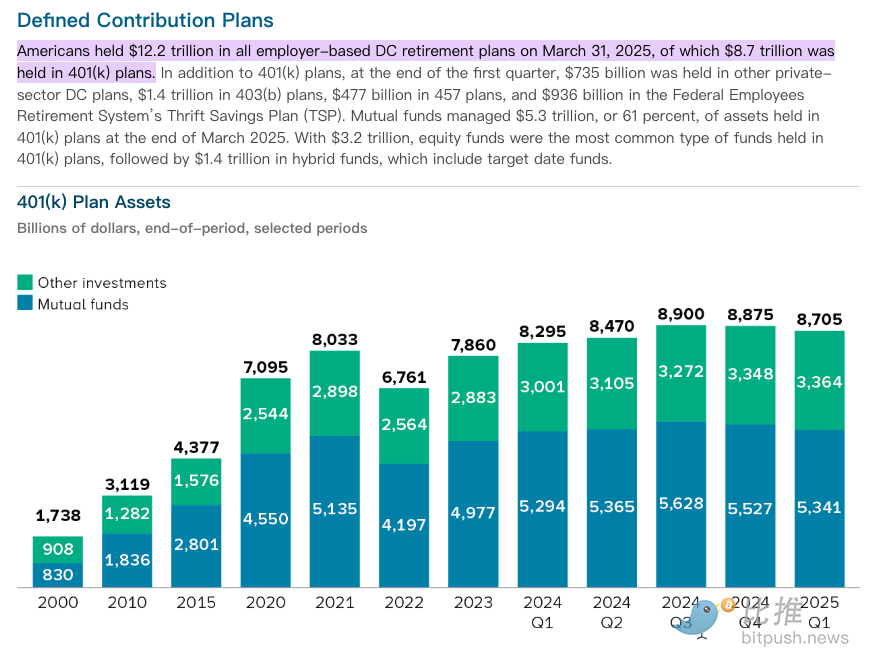

According to public data, by March 31, 2025, employer-sponsored defined contribution (DC) retirement plans had amassed $12.2 trillion in assets. Of that, 401(k) plans account for $8.7 trillion.

This vast pool of capital comes from tens of millions of American workers. The 401(k), as an employer-sponsored retirement plan with payroll deductions, tax incentives, and employer matching contributions, is the primary long-term savings vehicle for most working families.

Historically, these massive retirement assets have flowed primarily into public securities. By the end of March 2025, $5.3 trillion, or 61% of all 401(k) assets, were managed by mutual funds. Equity funds are the dominant type, holding $3.2 trillion, followed by Hybrid Funds (including Target-Date Funds) with $1.4 trillion. This traditional focus on stocks and bonds creates a large opening for Trump’s push into alternative investments.

IRAs (Individual Retirement Accounts) give individuals additional autonomy over their retirement savings. This cumulative wealth, built up by everyday Americans, constitutes the long-term capital. It fuels U.S. economic growth and market stability.

Similarly, both the U.S. and China have tried to build multi-layered pension systems. China’s “enterprise/occupational annuity” is similar to the U.S. employer-sponsored 401(k), while its “individual pension” shares features with the U.S. IRA. The U.S. move to open up pension investments thus carries lessons for global wealth management strategies among broad populations.

Private Equity Titans and the Battle for Trillions

Beyond crypto, this executive order presents a multi-trillion-dollar opportunity for global private capital giants like Blackstone, Apollo, and BlackRock. These firms are counting on major growth from managing everyday Americans’ retirement savings. The executive order would require the Department of Labor to explore “safe harbor” provisions for plan administrators, reducing their legal risk in offering high-fee, less liquid and less transparent private investments compared to public equities.

Private equity groups expect to draw in hundreds of billions of dollars in new assets by breaking into the 401(k) retirement market.

To seize this opportunity, they’re proactively forming partnerships with industry leaders: Blackstone has joined forces with Vanguard, while Apollo, Partners Group, and others are providing investment services to large 401(k) plan sponsors such as Empower. BlackRock has begun working with third-party retirement plan administrator Great Gray Trust.

While federal policy is still taking shape, some states are moving ahead with local pilots. Bitpush previously reported that North Carolina lawmakers proposed allowing certain retirement funds to allocate up to 5% to crypto. Michigan and Wisconsin pension systems have already invested in spot Bitcoin and Ethereum ETF, serving as an example for federal policymakers.

Persistent Headwinds

On the legislative front, the U.S. House passed three major crypto bills on Thursday: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. The CLARITY Act and the Anti-CBDC Surveillance State Act will head to the Senate, while the GENIUS Act is expected to be signed into law by President Trump as early as Friday. This is a meaningful step toward establishing a clearer legal framework for crypto industry growth.

Still, challenges remain. Palisade co-founder Manten Dave warned that without a clear, consistent regulatory framework in the U.S., companies may shift capital and innovation to jurisdictions with more predictable rules. Additionally, allocating retirement savings to less liquid private assets comes with risks—such as high fees, greater leverage, and lower transparency—which both regulators and investors must carefully weigh.

As Trump’s executive order contends with the $9 trillion retirement market, this policy experiment could redefine the concept of retirement savings. It could enable everyday Americans to share in the digital era’s benefits, or expose pensions to new risks. The outcome depends on how regulators balance innovation and investor protection.

Disclaimer:

- This article is republished from BitpushNews ( link ). Copyright belongs to the original author, BitpushNews. If you have any concerns regarding republication, please contact the Gate Learn team for assistance.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute investment advice.

- Translations into other languages are provided by the Gate Learn team and may not be copied, distributed, or reproduced without proper attribution to Gate.