Order-Flow Auctions and Early Mitigations

This module explores how early MEV mitigation tools emerged, focusing on concepts like MEV-Boost, private relays, and the rise of Order-Flow Auctions (OFAs). It examines the trade-offs involved in these designs and why they have led to a new class of architectural solutions that eventually culminated in SUAVE.

From Monolithic Proposers to Modular Builders

Traditionally, block proposers, who are miners in proof-of-work or validators in proof-of-stake had complete control over which transactions were included in a block and in what order. This gave them a powerful advantage, allowing them to extract MEV directly or outsource that right to third parties. The Ethereum Merge and the move to proof-of-stake introduced a new opportunity: decoupling block proposal from block building.

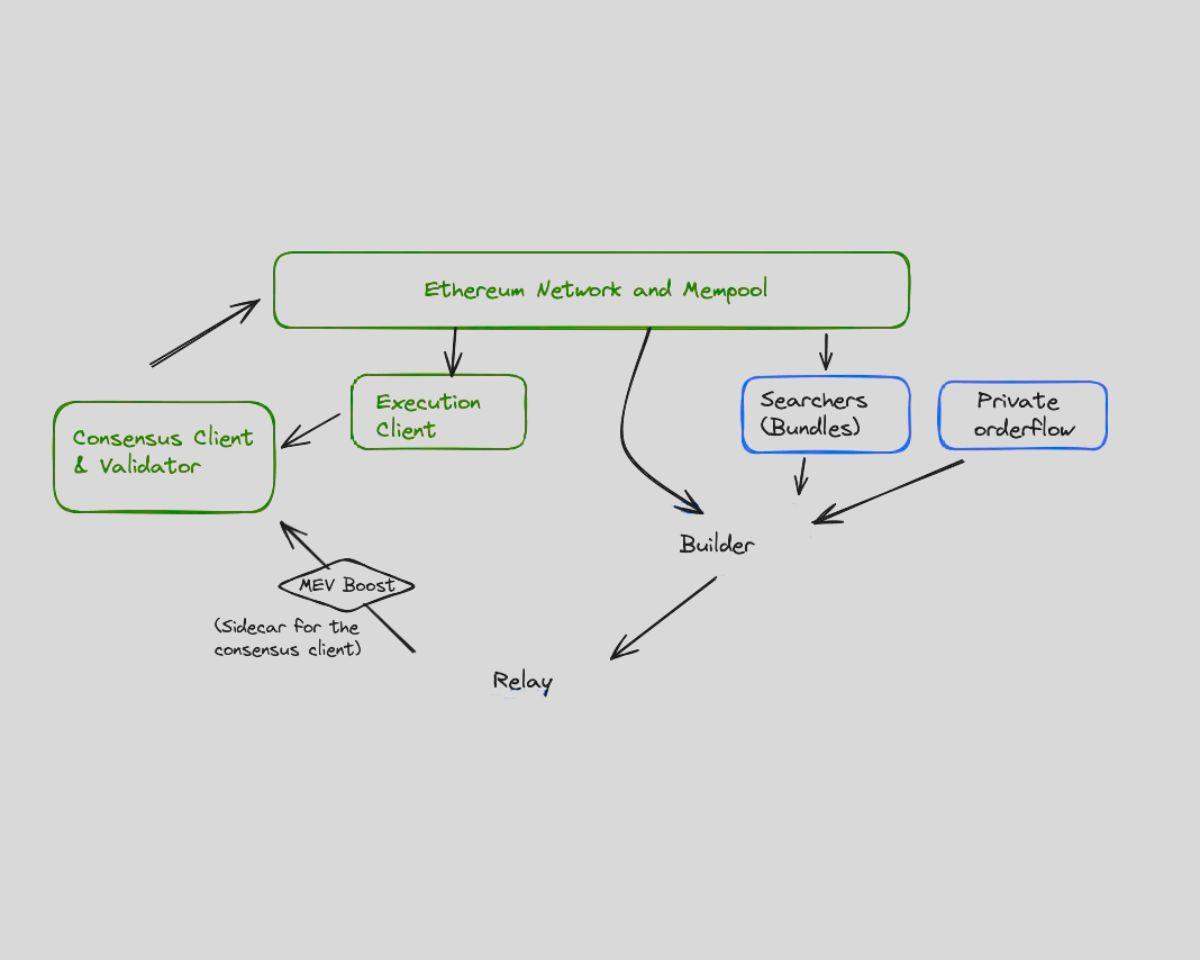

Flashbots introduced this concept with MEV-Boost, a middleware that allowed validators to outsource block building to an open market of builders. Instead of constructing blocks themselves, validators would receive pre-built blocks from competitive builders and select the one offering the highest bid. The system incentivized builders to compete for order flow by constructing the most valuable block possible and sharing the reward with the validator.

This separation created a more modular consensus architecture. It reduced the monopolistic control of validators over ordering and allowed new actors, such as searchers, builders, and relays to participate in block production. It also provided visibility into the MEV extraction process and encouraged standardization around ethical practices.

The Role of Searchers, Builders, and Relays

The MEV supply chain under MEV-Boost became more structured. At the base are searchers, specialized actors who scan the mempool, identify MEV opportunities, and generate transaction bundles. These bundles are submitted to builders, who aggregate them into blocks, along with regular user transactions and padding strategies to maximize profitability. Builders, in turn, submit their blocks to validators via relays.

Relays serve as intermediaries, verifying that blocks meet protocol rules and that promised payments will be made to validators. They act as a gatekeeper for trust, especially in cases where builders might fail to deliver on payment commitments. However, the existence of relays also introduces centralization risks, as only a handful of relays operate at scale and control large portions of validator engagement.

This supply chain allowed for transparency and specialization, but it also exposed new bottlenecks and trust assumptions. Builders gained increasing influence over which searchers’ bundles were included. Relays could censor blocks or go offline. Validators, while removed from direct MEV extraction, were still incentivized to collude with trusted builders for consistent income. These tensions revealed that while MEV-Boost mitigated some issues, it did not fundamentally change the game—it simply redistributed it.

The Limits of MEV-Boost and Private Order-Flow

MEV-Boost demonstrated that competitive block building could reduce centralization among validators, but it also revealed new problems. Builders started to consolidate market share, leading to builder dominance rather than validator dominance. Certain builders consistently won the most profitable blocks, while others fell behind, reducing the theoretical decentralization of the builder market.

Furthermore, MEV-Boost still relied on a public mempool, which meant that most user transactions remained visible and vulnerable before block inclusion. Some users and protocols responded by exploring private transaction submission methods. Projects like Eden Network and Taichi offered protected transaction routes that bypassed the public mempool and delivered user transactions directly to builders or validators.

These solutions introduced trade-offs. While they reduced exposure to frontrunning and sandwich attacks, they often required trust in centralized operators and sometimes charged fees for protection. They also broke composability, meaning transactions submitted privately could not interact with public mempool transactions in a predictable way. In essence, these mechanisms protected users but at the cost of transparency and protocol-level coordination.

Private mempools, such as those developed by Shutter Network or Gnosis Chain, went further by encrypting transactions until they were included in a block. This approach delayed transaction visibility, reducing MEV opportunities, but required complex coordination and introduced latency. Moreover, encrypted mempools reduced usability for apps that rely on real-time state estimation, such as arbitrage bots or portfolio managers.

The Rise of Order-Flow Auctions (OFAs)

A more promising development came with the rise of Order-Flow Auctions (OFAs). In this model, user transactions are not simply broadcast to the mempool or submitted to private endpoints. Instead, users—or wallets acting on their behalf—sell the right to include their transactions through an auction mechanism. Builders or solvers compete to win the right to execute the transaction, and the user receives a portion of the MEV value that would otherwise be extracted from them.

This approach shifts the narrative from MEV extraction to MEV sharing. It recognizes that user transactions have value and that this value should be compensated fairly. Projects like CowSwap and MEV-Share (a Flashbots prototype) allow users to express their transaction intent and receive a quote or rebate in return. The mechanism relies on trustless execution environments, cryptographic commitments, and sealed-bid auctions to prevent frontrunning.

Order-flow auctions also introduce a programmable market for transaction inclusion. Instead of relying on centralized protection, they create a permissionless and transparent way for users to submit transactions and receive fair execution. They encourage competition among solvers and builders and align incentives between users and infrastructure providers.

However, OFAs are still in early stages. They require integration at the wallet level, standardization across chains, and robust cryptographic design. Furthermore, widespread adoption demands that users understand the benefits of selling their order flow and that protocols can securely route transactions through auction layers without breaking existing functionality.

Why These Mitigations Are Not Enough

Despite significant progress, early MEV mitigation tools and OFAs fall short of providing full MEV resistance. MEV-Boost solves one layer of the problem but leaves others untouched. Private transactions offer localized protection but do not scale well or offer universal access. Order-flow auctions show promise but are fragmented and lack interoperability.

What all these approaches lack is a unified, decentralized, and programmable infrastructure that can serve as the execution layer for MEV-aware applications across chains. A system that combines encrypted transaction propagation, fair auction mechanisms, and programmable execution logic, all while preserving composability, latency guarantees, and user control.

This realization has led to the development of SUAVE, an ambitious architecture designed to absorb, decentralize, and reimagine the order-flow layer. SUAVE does not attempt to patch MEV extraction; it proposes to rebuild the infrastructure that makes it possible in the first place.